The ATO lets us have a little extra time for December lodgments so we can enjoy the summer holiday period. But once you’re back in the swing of things after a break (or busy trading period), you’ll need to plan for deadlines, lodgments and payments.

Remember, Single Touch Payroll Phase 2 is now mandatory, although some software providers have extensions in place. If your payroll software is STP2 compliant, upgrade now if you haven’t already. If your payroll has grown in the last year, you may need to look at upgrading your payroll software – talk to us, and we can get you set up on a solution that is better suited to your business.

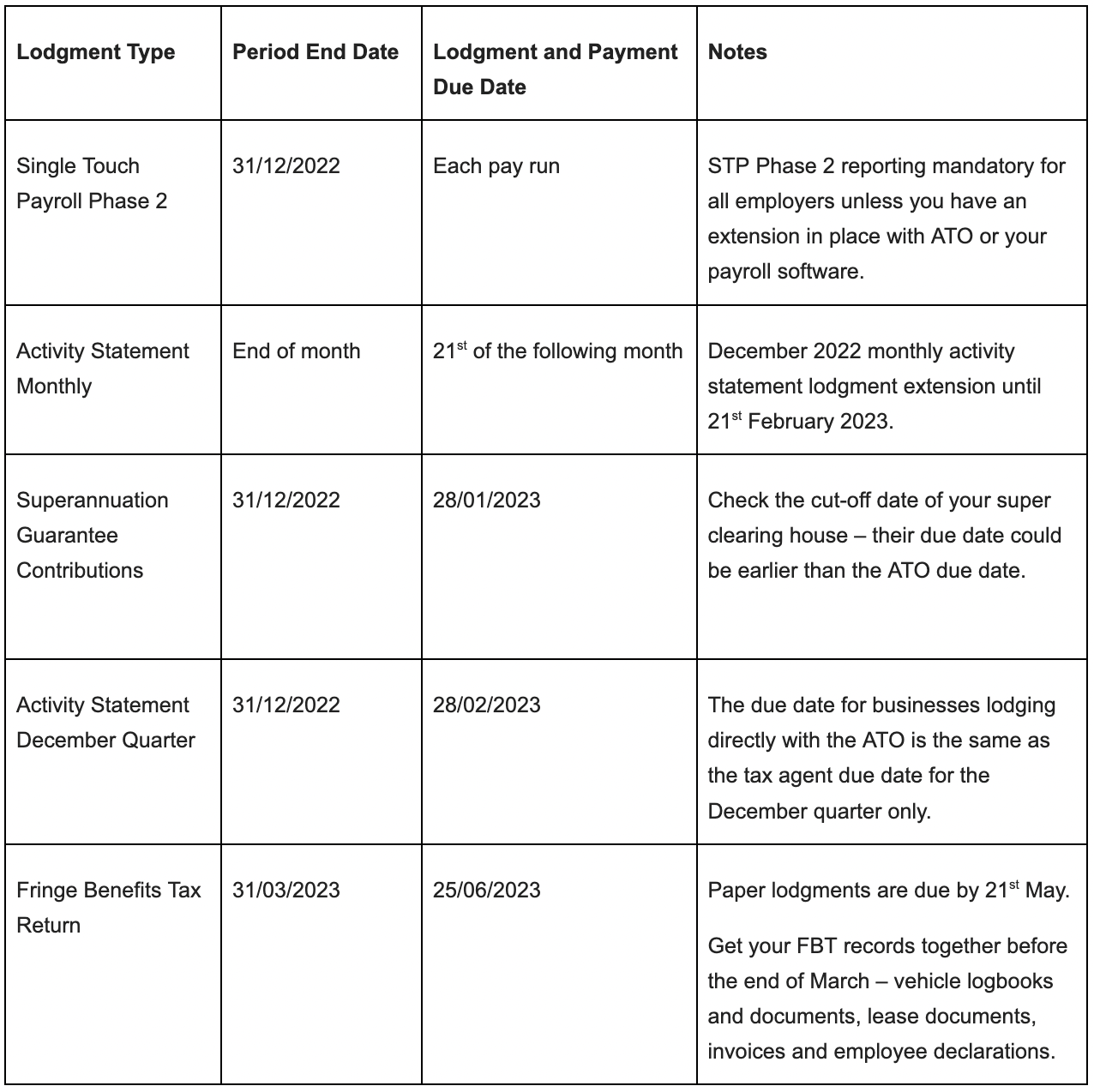

We’ve highlighted some upcoming business lodgment due dates to help you get organised for January to March, the third quarter of the 2023 financial year.

Talk to Us About Lodgment Planning

If we’re already lodging on your behalf, registered agent lodgment extensions automatically apply.

You may have earlier deadlines if you’re lodging activity statements and other forms directly with the ATO. If you need more time to lodge and pay, let us know, and we can help you meet your obligations or arrange a lodgment extension if required.

Some tax return due dates fall within the first quarter of 2023 – talk to us if you’re unsure of your business entity’s tax return due date.

It’s good practice to plan for your lodgment dates, so you’re always ahead with cash flow planning for ATO and superannuation liabilities.

If you are looking for a Xero Bookkeeper in Melbourne, Centegrity offers Xero Bookkeeping services as well as Business Mentoring to help grow your business without being Key Person Dependant. No matter what bookkeeping solution you need, we can help. Contact us or fill in the form below to get started.